Free Initial Consultations

630-580-6373

630-580-6373With offices in Naperville, Joliet, Wheaton, Plainfield & Chicago

Prenuptial agreements often carry a negative connotation. Yet, when one examines the details of some of the nation’s biggest divorces, the importance of a prenup becomes clear. Millennials are starting to change the way that we see them (they are signing these documents at an unprecedented rate), but maybe more can be done to help people see them for the useful tool that they are. One financial expert recently suggested that couples use it as a financial planning tool.

Prenuptial agreements often carry a negative connotation. Yet, when one examines the details of some of the nation’s biggest divorces, the importance of a prenup becomes clear. Millennials are starting to change the way that we see them (they are signing these documents at an unprecedented rate), but maybe more can be done to help people see them for the useful tool that they are. One financial expert recently suggested that couples use it as a financial planning tool.

If you are considering a prenuptial agreement, chances are, you already know you will one day be successful in business or money. Perhaps you have a knack for sales and have just made stockbroker. Maybe you see just how hard your spouse is working in medical school, and you are certain that they will be a successful physician. In either case, you envision a future that involves at least some measure of wealth.

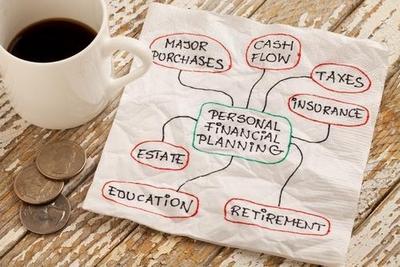

Rather than simply let that vision go to waste, use it to create a vibrant picture of your financial future. Set goals and milestones for achieving certain tasks, such as paying off your student loan debt or purchasing your first commercial property. Now take it one step further and consider how you want to spend your money, day-to-day. Would you rather invest? Are you interested in procuring certain assets? Do you want to donate a certain percentage of your earnings to a charity each year or quarter? In short, attempt to consider every element of your future wealth and then use it as a framework to prepare for the next steps.

Marriages are hard work, regardless of your asset class. However, those with a moderate amount of wealth may have a slightly higher than normal divorce rate. Financial experts say the reasons for this may be related to social pressures and fears over losing one’s wealth. Regardless, you can position the prenuptial as a method for resolving future conflict, and ensuring that any future children are protected in the event of a divorce. You can even add in clauses that require counseling or couple’s retreats before either party can file for a dissolution of the marriage.

At the end of the day, a prenuptial agreement is about far more than a divorce; it is a tool that you and your fiancé can use to shape your future. Discuss the issues that really matter - retirement, raising children, buying your first home - and decide how your financial goals fit into the equation. If necessary, take breaks from the discussion and return when you feel ready.

While you and your spouse can (and are encouraged to) use your prenuptial agreement as a way to broach, hold, and navigate money-related discussions, it is important to also ensure that your document is fully enforceable, should a divorce ever occur. Our Wheaton family law attorneys can help. Call 630-657-5052 to schedule a personalized consultation.

Source:

https://www.marketwatch.com/story/flip-the-prenup-into-a-financial-planning-tool-2019-01-15